8 min read

8 min readWith the American Dream of owning a home more challenging than ever to achieve, aspiring homeowners are asking themselves if it’s worth it to buy or is it better to just rent?

Here’s our analysis on the current state of renting vs. buying:

The cons of renting

If you’ve ever rented a home or apartment, you’re already familiar with the downsides (ah, the sweet memories of your upstairs neighbor playing bass guitar at 3 a.m.). But besides noisy neighbors, there are other negatives:

- Rent fluctuations – Typically, your lease will last for a year, during which you’ll be protected from a rent increase. As soon as the lease is up, though, plan on a rent increase. Though local laws usually protect renters by limiting how much rents can increase every year, there’s no cap on how many times a landlord can increase rent over the course of your occupancy. That means you can face a rent increase by the maximum percentage every single year. That affordable rent you had when you first signed the lease could double in less than a decade.

- No painting – Since you don’t own an apartment, you likely won’t have the freedom to paint, drill holes in the walls or perform other improvements such as upgrading the cabinets. You’ll need to adhere to your rental property’s rules and regulations.

- Rental deposit – To move into an apartment, you’ll need a rental deposit. That can fluctuate depending on local laws, but typically it’s at least the price of rent plus the first month’s rent in advance. If your rent is $1,200, expect to hand over at least $2,400 before you can move in.

- Lease constraints – When the lease is up, the property management company will require you to either sign a new lease or pay an increased month-to-month rent amount. Should you wish to move in the middle of your lease, you may have to forfeit your deposit and/or pay a fine to get out of your lease.

- Pets – Finding an apartment that accepts pets narrows your options for renting. Some landlords have weight and breed restrictions, and some even charge pet rent on top of the regular rent.

- No equity – You never get any of your rent back. You pay your landlord for the right to live in the space, and the money is gone forever. No equity is built, and there’s no return on your investment.

The pros of renting

It’s not all bad. There are some genuine perks to renting:

- Moving – If your lease is up, you can give notice, generally 30 days, and then leave without worrying about selling your place. Repairs – Your rental property is someone else’s responsibility, so someone else is responsible for maintenance and repairs. There’s something liberating about not having to replace a broken water heater.

- Deposit – Unlike a down payment, your rental deposit is returned when you move out of your apartment, assuming you’ve left it in perfect condition. (For some people, that’s a big assumption.)

- Insurance – While some complexes require renters insurance, many do not, which makes this an optional cost.

The cons of owning

A space of your own sounds dreamy, but the downsides of owning a home can be nightmarish.

- Neighborhood – It’s easier to afford rent in a posh neighborhood than it is to afford to buy a home in the same area. You may need to live farther away from your dream neighborhood in order to afford the mortgage.

- It’s yours – You’re responsible for maintenance and repairs, which means if the air conditioner breaks or the dishwasher leaks, you’ll need to fork over money for the unexpected expense.

- Property values – There’s no telling how much your home will be worth in 10 years. If your home’s value increases, great! But if it decreases, you may find yourself underwater.

- Taxes – Ah yes, government involvement. You’ll need to factor property taxes into your mortgage costs. Those taxes are likely to increase, too, which means higher payments.

- Moving – It’s much more difficult to move when you own a home, so if your neighbors are terrible or you live directly underneath a jet plane flight path, you’ll likely have to deal with it or go through the ordeal of putting your home up for sale.

- Insurance – You’ll need to pay homeowners insurance on top of your other costs.

The pros of owning

Home ownership is a tantalizing thought. Here are some great things about investing in your own place:

- Equity – Arguably the most compelling reason for owning a home, equity is the actual amount of your home that you own. Equity is a savings account in the form of a house. As you pay off more of your home mortgage and/or as your home increases in value, you’ll have more equity. Equity is also buying power, so you can borrow against your equity, partner with a co-investment company or use your equity to roll into the purchase of another home. When you make your mortgage payments, you’re paying interest, but you’re also paying into your equity. This is why a home is an investment and is the primary reason renting is different from owning.

- Tax write-offs – Paying interest on a loan is painful, but that pain is mitigated by tax write-offs. A portion of your interest can be used to decrease the taxes you owe the federal government each year. You may even qualify for a refund.

- Upgrades – Making home improvements usually increase the value of your home. If you overhaul and upgrade the kitchen, your home will likely appraise at a higher amount.

- Stability – Yes, there’s the emotional stability of always having a place to live, but there’s also the stability of knowing exactly how much your mortgage will be each month. Unlike rent, mortgage payments for fixed-rate mortgages remain the same throughout the duration of your loan, so you always know how much you’ll owe.

- Credit building – Owning a home and making on-time payments shows you’re a good borrower and are at low risk of defaulting, which means you’ll be able to qualify for more credit at lower rates.

- Do whatever you want – It’s your home, so if you want to turn it into an indoor skate park, go for it. You can remodel, redecorate and reconfigure to your heart’s content. Of course if you’re home is part of a homeowner’s association, you’ll want to play by the rules but having a home of your own certainly allows for more creative expression and customization.

Crunch the numbers

The numbers of renting versus owning vary depending on different factors, such as the price and location of the home as well as the current rental market.

However, for an idea of how renting compares to buying, here’s the low-down on numbers from major cities:

San Francisco

For a modest two-bed, two-bath home in San Francisco, expect to pay at least $800,000. The average rent for a one-bedroom apartment is $3,600/month. Assuming you have a 20% downpayment, the monthly cost of ownership is cheaper than renting after just three years of homeownership.

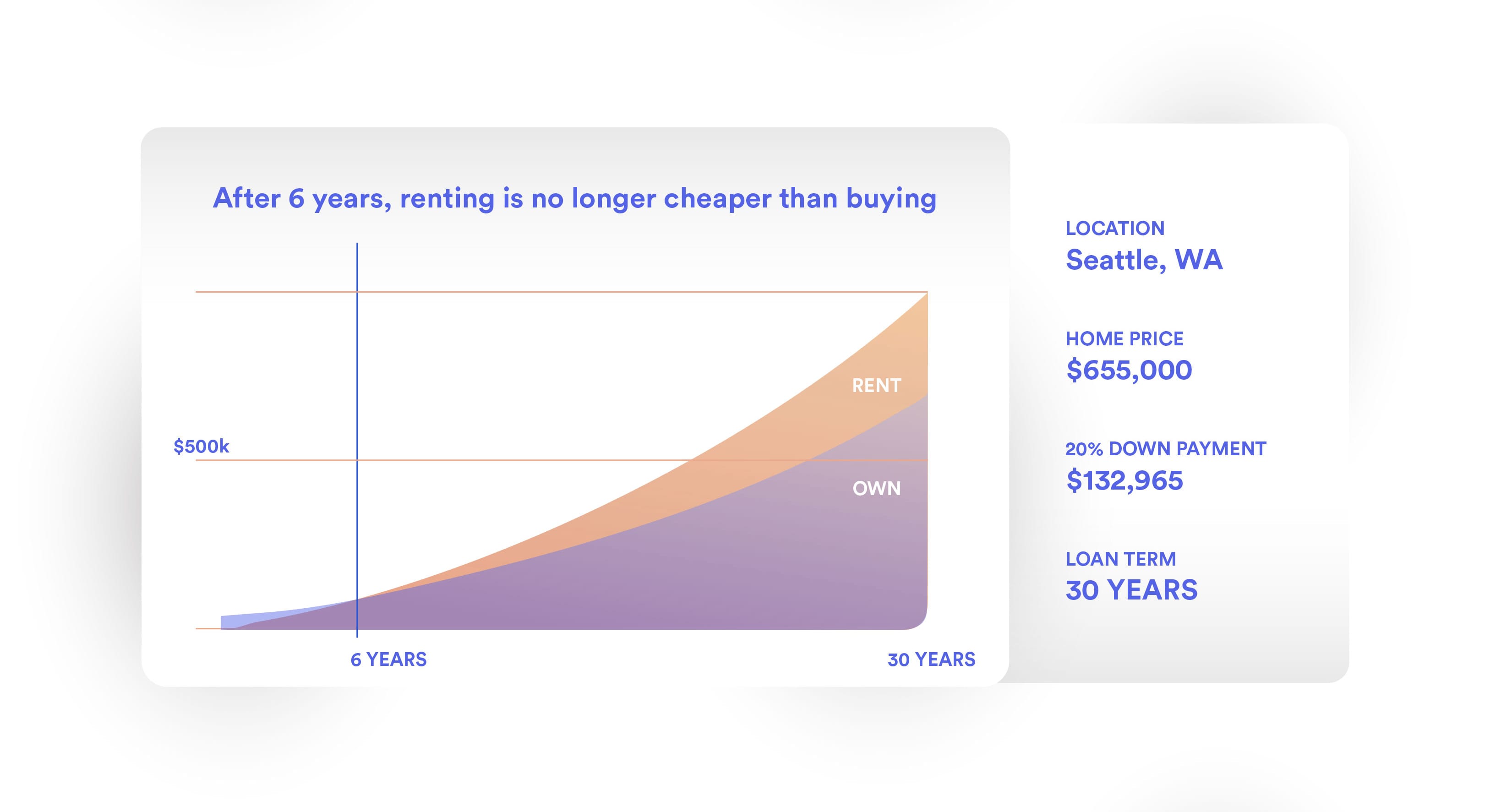

Seattle

The average one-bedroom will set you back $2,167 per month in Seattle. The current average home price in King County is $655,000. After paying a 20% down payment, after six years of owning a home, you’ll start spending less on a mortgage than you would paying rent.

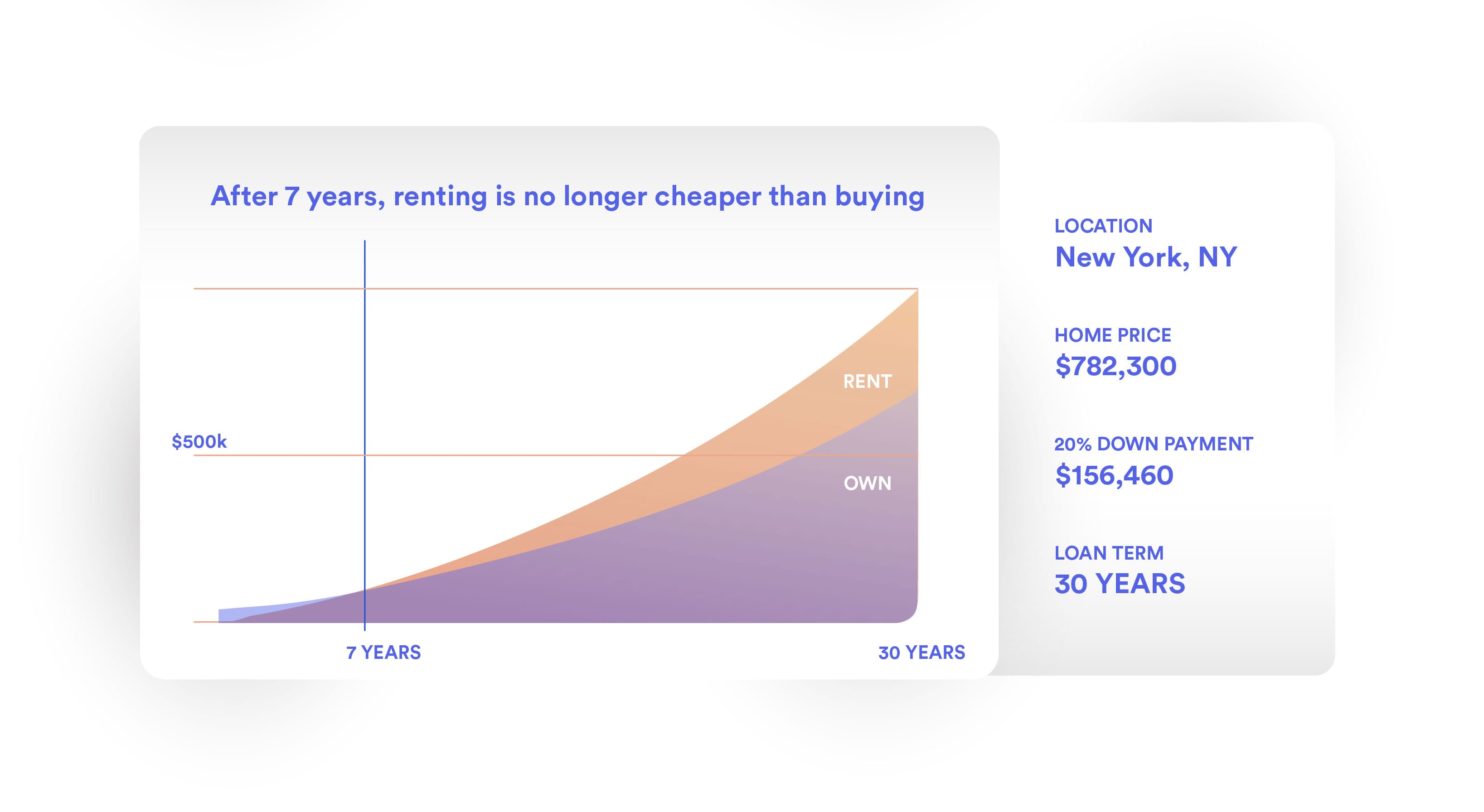

New York

The average price of a home in Brooklyn is $782,300, while the average rent is $2,700. If you pay a 20% down payment, you’d start seeing a savings after owning your fancy Brooklyn pad for seven years.

Down payment

The larger the down payment, the cheaper the mortgage, and the more money you’ll ultimately save. But if you don’t have the 20% of the total home price recommended to buy a home (which is a hefty amount, given the average price of homes in these high-cost cities), Unison can help. Through Unison’s home co-investing strategy, you’ll contribute as little as 5% of the total home price and Unison will contribute the remaining 15%. Unison then shares in either the appreciation or depreciation of the home once you sell, or after 30 years.

The final verdict

While there are many variables in determining if it is cheaper to own than to rent, owning normally makes more sense than renting. There are two caveats: time and down payment. The longer you stay in your home, the more affordable it will be as opposed to renting, and the greater down payment you’re able to initially invest will determine how much money you save on interest and mortgage costs.

Bottom line: Utilize a co-investment company to contribute a higher down payment and get lower monthly mortgage payments. And once you’re in your dream home, stay there for at least five years to make the most out of your investment.

The content on this page provides general consumer information. It is not legal or financial advice. Unison has provided these links for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of the other websites.