6 min read

6 min readIf your adult child is late to leave the nest, you’re not alone: 36% of homeowners have an adult child currently living with them. Families are coming together to overcome financial barriers, and providing your child with free housing is a great way to make money go further.

But you don’t want your child to just get by: You want them to thrive. You want to see them own a home, have a career and experience the hallmarks of a financially secure life. So, to that end, there are several ways to help your adult children flourish in the current economic climate while also protecting your own finances and your own retirement.

Life is more expensive now than it’s ever been. There’s a good chance your children are paying their share of our national $1.5 trillion student loan debt while also shouldering a $23,438 car loan. Plus, even if your child has a full-time job, rent can eat up a large portion of it: In Los Angeles, the average person uses 45% of their salary to pay rent. Your children may very well be working and still find there simply isn’t enough money every month to cover their auto loans, student loans, food bills, cell phone bills, utility bills, healthcare deductibles and all the other expenses of living.

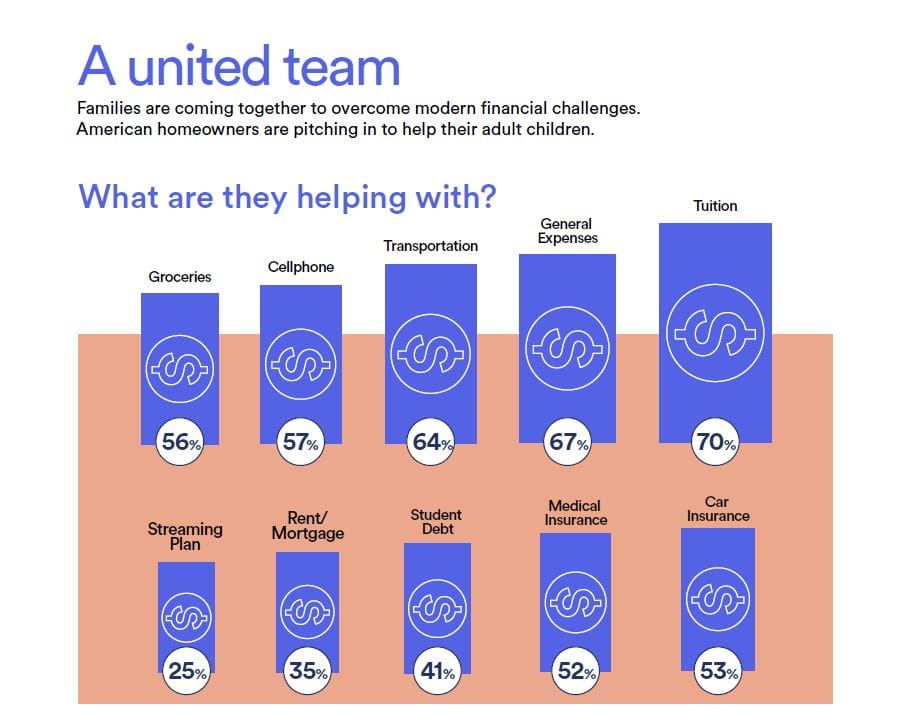

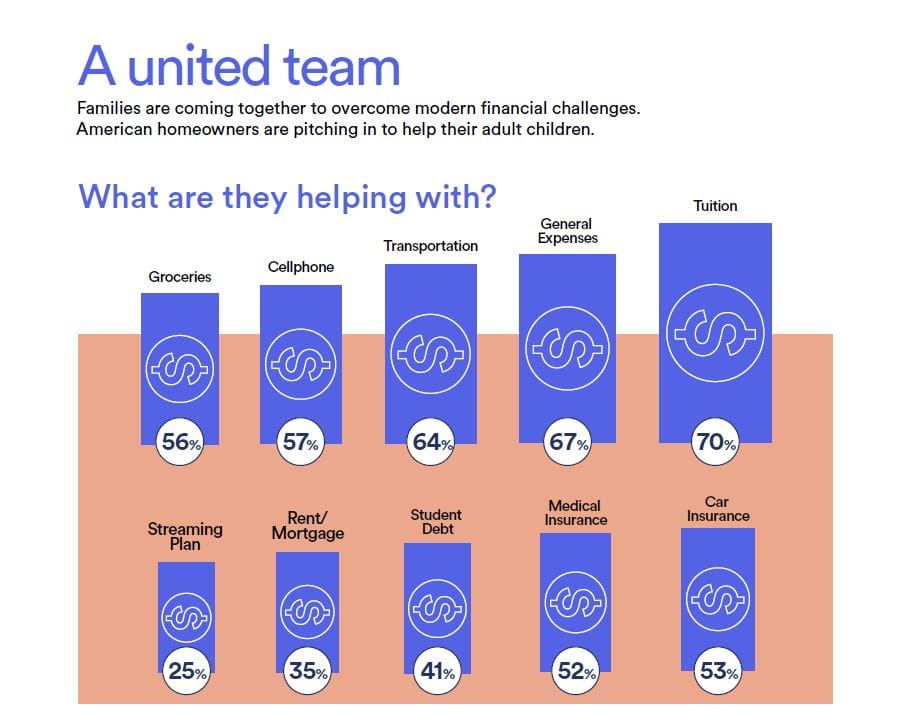

We’re sure you’ve seen it firsthand. And you’ve probably even pitched in. You may not even realize how often or how much you’re helping out, so to put it in perspective, here's how many American parents are financially assisting their adult child with the following:

70% tuition

67% general expenses

64% transportation

57% cellphone

56% groceries

53% car insurance

52% medical insurance

41% student debt

35% rent/mortgage

25% streaming plan

Even if you’re only contributing financially in one or two categories, that adds up over time. And all that money has to come from somewhere.

Look back at your PayPal or Venmo transaction history and add up how much money you’ve sent your adult child over the past six months (this may not apply to you, since some parents pay bills directly or use cash, but try it out if you send money via apps). How much was the total? Consider how much that amount would have earned in interest had it been left in a savings account.

Parents supporting their adult children are drawing from savings, retirement, home equity and even taking on loans to support their kids. Here's how the data breaks down:

Savings account/CD: 41%

401(k)/IRA/retirement fund: 8%

Loans: 8%

Home equity: 5%

The first two statistics are the most troubling because they indicate a large portion of adults are taking money from their future. That’s not smart. And lending your adult kid money may be helping in the short term, but it isn’t solving the root of the problem: namely, that your child is just getting by and not thriving.

Here are two smarter ways to help launch your adult child into financial solvency while protecting your retirement and assets.

With a home equity sharing solution, you can access the equity in your home and use that money to help your adult child pay off student loans or as a gift toward a down payment. When you sell your home, the home equity sharing company shares in a percentage of the home’s change in value, up or down. You won’t pay interest or monthly payments.

This is a great solution for adult children who need a lump sum of cash to get out of debt and start getting ahead. And you won’t have to touch your retirement or savings accounts.

But it doesn’t need to be that way.

With a home equity sharing solution aimed at helping home buyers, your child may only need 10% for a down payment — and sometimes as little as 5%. The home equity sharing solution will contribute the remaining 10% or 15%. Just like the previous solution, there’s no monthly payments: The co-investment company shares in the percentage of the home’s increase in value once it sells, or at the end of the agreement term (up to 30 years).

Consider presenting this solution to your child: It’s a smart way to help them get into a home faster while avoiding drawing from your own retirement or savings.

The right option depends on your child’s situation, so look at the long-term benefits instead of short-term solutions. For instance, if your adult child has a massive amount of student loan debt that increases faster than it can be repaid, using the first option may be the right solution to help your child flourish.

However, if homes are so expensive that your adult child is putting off moving out, the second option may be best. Either way, home equity sharing is a smarter solution than borrowing against your own retirement.

We believe that our children should have a better quality of life than we had at their age. But in today’s economic reality, that’s difficult to achieve. The right answer is utilizing smarter solutions and coming together as a family to make sure children have the right resources to thrive and parents have enough money set aside for a fantastic retirement in the future and financial health in the present.

The content on this page provides general consumer information. It is not legal or financial advice. Unison has provided these links for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of the other websites.

But you don’t want your child to just get by: You want them to thrive. You want to see them own a home, have a career and experience the hallmarks of a financially secure life. So, to that end, there are several ways to help your adult children flourish in the current economic climate while also protecting your own finances and your own retirement.

A dose of reality

Life is more expensive now than it’s ever been. There’s a good chance your children are paying their share of our national $1.5 trillion student loan debt while also shouldering a $23,438 car loan. Plus, even if your child has a full-time job, rent can eat up a large portion of it: In Los Angeles, the average person uses 45% of their salary to pay rent. Your children may very well be working and still find there simply isn’t enough money every month to cover their auto loans, student loans, food bills, cell phone bills, utility bills, healthcare deductibles and all the other expenses of living.

We’re sure you’ve seen it firsthand. And you’ve probably even pitched in. You may not even realize how often or how much you’re helping out, so to put it in perspective, here's how many American parents are financially assisting their adult child with the following:

70% tuition

67% general expenses

64% transportation

57% cellphone

56% groceries

53% car insurance

52% medical insurance

41% student debt

35% rent/mortgage

25% streaming plan

Even if you’re only contributing financially in one or two categories, that adds up over time. And all that money has to come from somewhere.

Robbing Peter to PayPal

Look back at your PayPal or Venmo transaction history and add up how much money you’ve sent your adult child over the past six months (this may not apply to you, since some parents pay bills directly or use cash, but try it out if you send money via apps). How much was the total? Consider how much that amount would have earned in interest had it been left in a savings account.

Parents supporting their adult children are drawing from savings, retirement, home equity and even taking on loans to support their kids. Here's how the data breaks down:

Savings account/CD: 41%

401(k)/IRA/retirement fund: 8%

Loans: 8%

Home equity: 5%

The first two statistics are the most troubling because they indicate a large portion of adults are taking money from their future. That’s not smart. And lending your adult kid money may be helping in the short term, but it isn’t solving the root of the problem: namely, that your child is just getting by and not thriving.

Solving for X

Here are two smarter ways to help launch your adult child into financial solvency while protecting your retirement and assets.

The debt problem

If you’ve owned your home for some time, you likely have a substantial amount of equity in it. But while that equity is technically yours, it’s something like owning a sum of money in a bank vault, but you don’t know the code to access it. The old solutions for unlocking equity involved adding more debt to your mortgage, but then you’d need to pay that back in monthly installments with additional interest. That’s not solving anything.With a home equity sharing solution, you can access the equity in your home and use that money to help your adult child pay off student loans or as a gift toward a down payment. When you sell your home, the home equity sharing company shares in a percentage of the home’s change in value, up or down. You won’t pay interest or monthly payments.

This is a great solution for adult children who need a lump sum of cash to get out of debt and start getting ahead. And you won’t have to touch your retirement or savings accounts.

The home problem

It now takes an average of 14 years to save for the 20% down payment recommended to buy a home. If your child is living with you to save money for a down payment, it could mean that the same child who lived with you at 20 may very well still be living with you when they turn 34.But it doesn’t need to be that way.

With a home equity sharing solution aimed at helping home buyers, your child may only need 10% for a down payment — and sometimes as little as 5%. The home equity sharing solution will contribute the remaining 10% or 15%. Just like the previous solution, there’s no monthly payments: The co-investment company shares in the percentage of the home’s increase in value once it sells, or at the end of the agreement term (up to 30 years).

Consider presenting this solution to your child: It’s a smart way to help them get into a home faster while avoiding drawing from your own retirement or savings.

Choosing your solution

The right option depends on your child’s situation, so look at the long-term benefits instead of short-term solutions. For instance, if your adult child has a massive amount of student loan debt that increases faster than it can be repaid, using the first option may be the right solution to help your child flourish.

However, if homes are so expensive that your adult child is putting off moving out, the second option may be best. Either way, home equity sharing is a smarter solution than borrowing against your own retirement.

We believe that our children should have a better quality of life than we had at their age. But in today’s economic reality, that’s difficult to achieve. The right answer is utilizing smarter solutions and coming together as a family to make sure children have the right resources to thrive and parents have enough money set aside for a fantastic retirement in the future and financial health in the present.

The content on this page provides general consumer information. It is not legal or financial advice. Unison has provided these links for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of the other websites.