6 min read

6 min readBy Jia Taylor, Content Marketing Lead

In This Article

- How credit scores are calculated.

- Factors that impact your credit score.

- What is considered a good credit score?

- How long does it take to rebuild your credit score?

- Tips to increase your credit score.

Whether you’re looking to get a mortgage for a house, take out a loan to buy a car, or get your small business up and running, your credit is essential to achieving your financial goals and can impact your financial health and wellness.

Establishing good credit may seem like a complicated process, but it doesn’t have to be an ordeal. If you want to increase and maintain a high credit score, there are simple things you can do. Here, we break down the five biggest factors that affect your credit score and five easy steps you can take to give your credit score a boost.

How Credit Scores are Calculated

You may realize that you don’t have just one credit score. Credit scores are calculated by complex mathematical algorithms called credit-scoring models that analyze one of your credit reports from three major credit bureaus–Experian, TransUnion or Equifax. The reason we have so many different credit scores is that not all credit-scoring models measure the same things in the same way.

Credit scores may differ for several reasons, including the company providing the score, the data on which the score is based, and the method of calculating the score. Credit scores may also differ because not all lenders and creditors report information to all three major credit bureaus.

While the credit-scoring models among the three major credit bureaus are different, the vast majority of lenders use credit scores calculated by FICO and VantageScore scoring models. Instead of focusing on one credit score, it’s more important to look at the range your credit score falls in and the principles used to create them.

Factors that Impact Your Credit Score

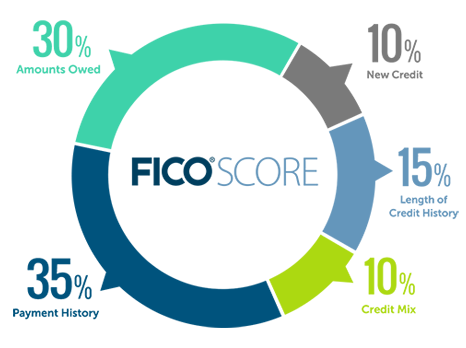

By understanding what factors impact your credit score, you can take steps to improve it. The credit data in your credit report is used to calculate your FICO Score. This data is grouped into five categories. In general, here are the factors considered in calculating your credit score, keeping in mind there are many different credit-scoring models.

1. Payment History (35%) Keeping up with your payments has the biggest impact on your credit score. It makes sense–lenders are naturally invested in your ability to pay back debt promptly and punctually. If this is not your forte, you can set up automatic bill payments and reminders about upcoming and recurring due-dates. It’s a good idea, too, to establish and maintain a monthly budget or savings plan.

2. Amounts Owed (30%) After payment history, the amount you owe as represented by your credit utilization ratio, is the second most important factor in your credit scores. FICO scrutinizes the amount of money you owe versus how much credit is available to you. For example, if your card balance is $500 and you have a spending limit of $2,500, your credit utilization is $500/$2,500 or 20%. As a general rule of thumb, it’s best to keep your revolving credit balances under 30% of your credit limit, but financial experts recommend keeping your credit utilization under 10% if you want an excellent credit score.

3. Length of Credit History (15%) In general, the longer an individual has had credit, the better their score. However, even people who have not been using credit long can get a good credit score, depending on their payment history and amounts owed.

4. Credit Mix (10%) Credit mix means having a variety of credit accounts and how well you manage the blend. To obtain high credit scores, you need a strong mix of accounts which might include a car loan, credit card, student loan, mortgage or other credit products.

5. New Credit (10%) Borrowers who open too many new credit accounts in a short period of time can be a sign of risk for lenders—especially for people who don't have a long credit history–and as such can hurt your credit score.

What is Considered a Good Credit Score?

FICO credit scores can range from 300-850, while industry specific scores can range from 250-900.[1] According to Experian, a credit score of 700 or above is generally considered good.

FICO

- 300-579: Very poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-850: Exceptional

The higher your score is, the less risky you are to potential lenders. A higher credit score signals you have demonstrated responsible credit behavior in the past, which may make lenders and creditors more confident when evaluating a request for credit.

How Long Does It Take to Rebuild Your Credit Score?

When it comes to rebuilding your credit, unfortunately, there’s no quick fix. How long it takes to increase your credit scores depends on what's hurting your credit and the steps you're taking to rebuild it.

It’s important to keep in mind that negative information like missed or late payments can hurt your credit for years.That’s because negative information can remain on your reports for up to seven years and certain types of negative information can stick around for even longer. For example, bankruptcies might appear on your reports for up to 10 years. But the good news is that most negative information won’t impact your score forever.

5 Tips to Increase Your Credit Score

Now that you know what factors affect your credit and how long it takes to rebuild it, you can be proactive by taking these steps to help increase your credit score.

1. Pay off debt in a timely manner. Late payments, even a couple of days, can cause your score to drop significantly. Making regular, on-time payment of the minimum amount (or greater) helps lower your credit utilization and will improve your credit score.

2. Keep your credit card balances low. If your balances are high, outline a strategy to lower the balance owed. Don’t just pay the monthly minimum, if possible.

3. Keep credit cards open. If you close a credit card, you might negatively affect your score. Place a small recurring charge on any cards you aren’t using (such as a phone bill or subscription account such as Netflix) to keep the cards active.

4. Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry which may hurt your credit scores. Hard inquiries stay on your credit report for two years, though their impact on your scores fade over time.

5. Dispute any inaccuracies on your credit report. You should regularly monitor your credit reports to make sure no inaccurate information appears. If you find something wrong, contact the credit bureau and the business that reported the inaccurate information as soon as possible.

Take the Next Step

Whether it’s paying off credit card debt from renovation costs or medical bills, with a Unison equity sharing agreement, you can access your home equity to tackle your debt, which can improve your credit and increase your credit score–all without a monthly payment or interest. Instead, Unison shares in the future change in value of your home over time, up or down.[2]

You won’t be able to turn your credit around overnight, but if you start taking steps now to improve it, you will see results in time! Learn more about the benefits of a homeowner partnership with Unison.

[1] https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

[2] Unison will not share in any decrease in value if you sell your home within five years of our investment or if you opt to buy us out without selling your home. In addition, if you do not properly maintain the condition of your home and it results in a significant decrease in your home’s market value, Unison reserves the right to offset the decrease in value with a commensurate upward adjustment for purposes of calculating our share of the change in value of your home.“Estimated Pre-approval Amount” is an estimated value of the amount of equity you can access from your home and it is based on our assessment of automated valuation models (AVMs) and other valuation tools. An independent third party appraiser will determine the final home value, which will impact the amount available to you.

The content on this page provides general consumer information. It is not legal or financial advice. Unison has provided these links for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of the other websites.